Marketing for fintech: 8 strategies to drive conversions

Striking the right balance between compliance and innovation is the foundation of fintech marketing success. Not only do US-based fintech brands need to comply with SEC regulations, but the fintech market is growing—and competition for consumer attention is expanding right along with it. A strong fintech marketing strategy focused on building customer trust is more important than ever.

Of course, determining how to market a fintech company both compliantly and effectively is no easy feat. It relies on a deep understanding of your customers and having a multitude of marketing channels at your disposal. That’s how you lay the groundwork for enhanced acquisition, growth, and retention—the key to winning consumer trust over the competition.

Here’s what we’ll be covering today:

- Strategy 1: Personalized messaging at scale

- Strategy 2: First-party data for paid ads

- Strategy 3: Advocacy and community

- Strategy 4: Security and compliance messaging

- Strategy 5: Optimizing for mobile

- Strategy 6: Solving KYC needs with SMS and push notifications

- Strategy 7: In-app messaging for better engagement

- Strategy 8: Experimentation and iteration

8 fintech marketing strategies that will help you build trust at every turn

Money is deeply personal, customers are wary of risk, and plenty of people get nervous about online security regarding their financial data. That’s why you have to both talk the talk and walk the walk in fintech marketing.

Here are eight powerful fintech marketing strategies that will help you build a foundation of trust that leads to long-term customer relationships.

Strategy #1: Personalized messaging at scale

Trust is especially important when you’re dealing with people’s money. Fintech marketing campaigns need to take every opportunity to cultivate it, and one of the most effective ways to do so is through personalization.

Individually tailored content reassures customers that you really know them and that you’re handling their finances expertly. A few key ways to implement personalization in fintech digital marketing:

- Accurately reflect customer data in your messages: From their demographic details (like name and location) to their account information (like balances and activity), be sure every personalized element of your messages is accurate. There’s no quicker way to lose customer confidence than to send a message with the wrong information!

- Celebrate meaningful milestones: From activation to onboarding to retention, key milestones in your customers’ lifecycles mark when you cement deeper engagement. So when people reach them, celebrate! A personalized message that reflects what they’ve done and why it benefits them can engender an appreciation for the value of your product and make people feel seen.

- Tailor your messages to individuals’ locations: By personalizing messages with location-specific data, you’ll ensure your messages are accurate, relevant, and easier to engage with. Schedule messages to arrive at the ideal moment across time zones, display times and dates in each individual’s local time, and if you operate in more than one country, be sure to use the appropriate currency and language.

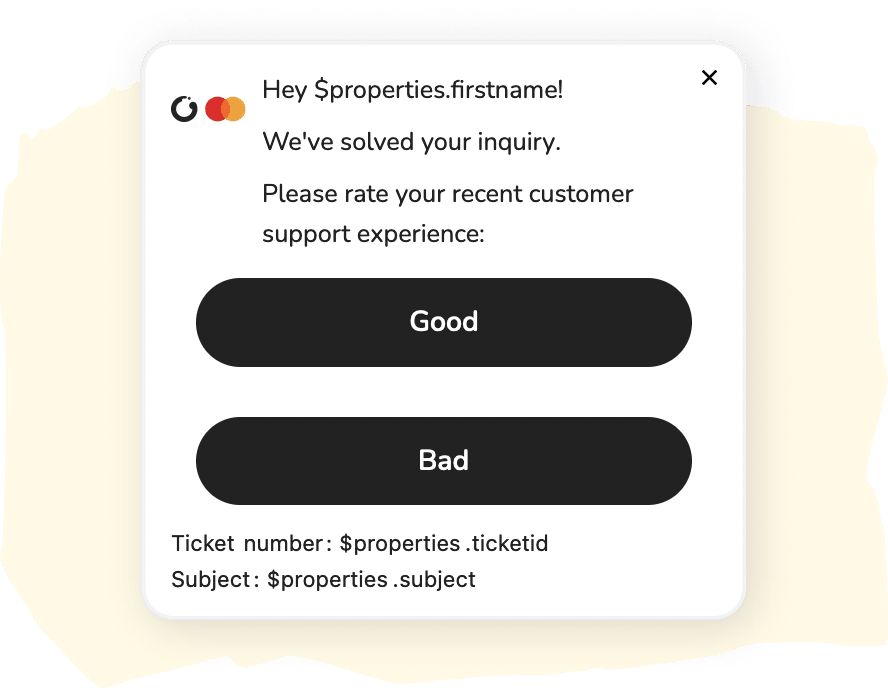

Personalization in action: ZEN.COM’s tailored in-app survey

ZEN.COM, an all-in-one finance and shopping app, makes customer service interactions even more effective with a personalized follow-up. When a ticket is closed, they send an in-app survey to request feedback, personalizing the message with details about the resolved issue. Learn more about ZEN.COM’s in-app survey.

Customer.io pro tip: Personalize international fintech marketing

When your audience spans across countries, you have more potential pitfalls—but also more opportunities to make every message highly personalized. Explore these four ways to tailor Journeys campaigns for customers in any location:

- Customize currency: Use Liquid to customize the currency displayed in your messages based on the country where each customer lives.

- Format dates: You can also use Liquid to dynamically display a date in the correct format for each individual based on location.

- Tailor time zones: Set up delivery time windows to schedule messages to arrive within the specific time frame you want in customers’ local time zones.

- Simplify workflows: To keep workflows clear and avoid errors, create multiple workspaces within Journeys to separate audiences from different countries or regions.

- Track conversions: With conversion goals, you can measure the specific outcome you want for each campaign and compare results across international markets to better understand your audience segments.

Recommended reading: Real-time personalization: the what, why, and how

Strategy #2: Power paid ads with first-party data

If your fintech marketing strategy includes paid advertising, you must contend with Google’s phase-out of third-party cookies for Chrome in 2024. But the cookiepocalyple doesn’t have to crumble your plans! In fact, the key to successful ad targeting is the very thing that drives personalization in your messaging campaigns: first-party data.

First-party data is the direct information you collect about your customers, such as site visits, app/platform usage, customer service requests, and other activities. Try these tips for tapping into the power of your first-party data:

- Use a customer data platform (CDP): This software will help you synthesize data from every touchpoint and feed it into all the tools in your martech stack.

- Understand your audiences: Dig into your analytics for a nuanced view of your ideal customer profiles and behaviors.

- Target your ideal customers: Use the information you have about your best customers to create lookalike audiences within ad networks. That way, you’re more likely to reach the people engaging with your ads.

Customer.io pro tip: Create targeted advertising with first-party data

Combining Data Pipelines (our CDP) with Ad Audience Sync in Journeys lets you tap into the power of your first-party data for more powerful advertising. Here’s how to do it:

- Unify your customer data with Data Pipelines and send it to Journeys in real time.

- Use Ad Audience Sync to connect your Journeys segments to ad networks and create targeted campaigns for your audience.

Strategy #3: Inspire brand advocacy and community

How do prospective fintech customers know who to trust? They look to the feedback and reviews of other customers! In fact, word of mouth is one of the most powerful drivers of acquisition and loyalty for fintech platforms (source).

You need to motivate passionate advocates, but how? To market a fintech company through word of mouth, try these three tactics:

- Let your product lead: When you make something that delivers genuine value, it pretty much markets itself. That’s the strategy behind product-led growth; whether you follow that specific model or not, ensuring customers love your product enough to shout it from the rooftops is fundamental to building word of mouth.

- Help customers share the love: The easier it is to advocate for your brand, the more likely customers will do it. Review requests, referral programs, forward-worthy email newsletters, and educational content give your customers plenty of pathways to brag about your company.

- Build and nurture community: Where is your community, and how can you nurture it? When marketing for fintech, you have an eager audience of personal finance enthusiasts—connect with them! For example, when Stripe acquired Indie Hackers, it was a win-win for everyone. Stripe tapped into the passionate Indie Hackers community, and that community got more capital and resources to grow (source).

Community-building in action: Hi.com’s onboarding strategy

Web3 neo bank Hi.com knows their customers need education and encouragement as they begin their onboarding journey. That’s why they send an in-app message inviting people to their community for advice and tips from like-minded folks. Head to minute 27 of the video to hear how they drive engagement in onboarding (and beyond).

Strategy #4: Keep security and compliance top of mind

Customers need to believe in your integrity—and assuring them of your commitment to compliance builds an unwavering foundation of trust. Make it clear how you protect personal identifiable information (PII) and financial data throughout your customer communications. Here’s how:

- Highlight your practices: From data security to compliance with regulations, give customers insight into your brand’s policies and practices. And don’t bury the info in a footer link—give your security messaging pride of place, explaining how your processes benefit customers.

- Educate customers: In fintech, content marketing can be particularly effective because it empowers people with the knowledge they need to feel in control of their money. Educational content gives customers the why behind the how of your security and increases your trustworthiness.

- Reinforce your message regularly: Bolster trust with ongoing assurance. For example, when you require a 2FA setup, tell customers why it matters. Or, in your transactional messages, reiterate how you keep information secure. Furthermore, when you send required disclosures and policy updates, go beyond the legalese and explain what it means in plain language—and why it’s important.

Customer.io pro tip: Partner with a platform that puts security first

You’ve gone to great lengths to ensure your product meets stringent security requirements—make sure the tools in your tech stack are up to snuff as well. When you use Customer.io, you can depend on best-in-class security and compliance in both our policies and technology. Learn how we keep your data secure.

Strategy #5: Optimize messaging for mobile

Your customers will receive many fintech digital marketing messages on their phones. According to our State of Messaging Report:

- 66% of customers prefer to read emails on their phones or tablets.

- 13% of brands expect mobile messaging to have a significant impact on customer engagement in 2024.

- Fintech companies allocated 34% of their messaging volume to push notifications in 2023—far more than other industries.

These trends highlight the importance of optimizing your fintech marketing strategy for an audience engaged on mobile devices. Put these two principles at the core of your campaigns:

- Think mobile first: When designing fintech marketing campaigns, strategically incorporate mobile messaging from the start. Instead of wedging in SMS, push, or in-app alongside email campaigns, take an omnichannel approach to create a holistic customer experience across every customer touchpoint.

- Build responsive emails: Your customers check email on their mobile devices, so your messages must perform as flawlessly there as they do on desktop. Use responsive design to optimize your fintech email marketing for the devices your customers are using.

Recommended reading: Mobile messaging trends for 2024: What marketers need to know

Strategy #6: Smooth out Know Your Customer (KYC) friction with SMS and push notifications

Identity verification, income confirmation, and due diligence checks—KYC steps are crucial for compliance. Still, they also introduce friction into the activation process, increasing the risk that customers will abandon your product before they can even use it.

This is where mobile messaging can save the day. An SMS or push notification can get in front of customers fast, spurring them to take necessary action. And you can combine mobile messaging with other channels to effectively guide customers through the process.

- Trigger messages based on customer actions: You have a clear set of steps that customers must complete in sequence. Move them along by triggering an SMS each time they finish an action, confirming what they’ve done and leading them to the next step.

- Bolster mobile messaging with other channels: SMS and push notifications call for short content with single calls-to-action. They’re great for nudging customers along a path but lack the ability to provide additional context. Complement your mobile messages with an email overviewing the KYC and onboarding process. You can also harness push notifications to bring people into your app and then greet them with an in-app message when they get there.

- Choose the right channel for each message: Don’t be the brand that cried wolf; ensure your mobile messaging is timely and important—especially since it can feel quite disruptive for customers when used too often. For example, in fintech, content marketing can be very effective, but if you distract customers with unrelated content while trying to get them to complete KYC actions, they’re more likely to leave you on read.

Recommended reading: 7 content tips for better SMS engagement

Strategy #7: Take conversations in-app to increase engagement

In-app messages arrive at a particularly ripe moment for conversion: when customers are already engaged with your product. So when you want to spark immediate action, meet customers where they are with in-app messages relevant to their activity.

Consider these tips for in-app messages that drive conversion:

- Make it personal: Personalization is especially powerful for in-app messages. By targeting messages based on what people are doing in the app and where they are in their journey, you can make customers feel as if your product was built especially for them.

- Use mobile SDKs: Personalizing messages based on customer data is faster and easier with mobile SDKs, so take advantage of them to leverage customer data more effectively.

- Invite conversation with surveys: In-app surveys give customers a chance to be heard—which increases their engagement—and lets you gather valuable intel about their experience—which helps you enhance your product.

In-app messaging in action: Bamboo’s success story

Investment app Bamboo crafted a multi-channel email, SMS, and push strategy for their high-frequency messaging approach but found that push notifications weren’t performing well. So they added in-app messages to the mix—and doubled conversion rates. Get the details on Bamboo’s successful multi-channel strategies.

“Messaging frequency is key for our strategy. We can’t email our customers daily, so increasing frequency with a multi-channel strategy is how we can scale message volume. The conversion rates prove that strategy is working.”

— Ugo Iwuchukwu, Head of Marketing & Partnerships, Bamboo

Recommended reading: Mobile app personalization with in-app messaging

Strategy #8: Experiment, iterate, improve, repeat

The messaging landscape is evolving just as quickly as the fintech industry itself—what’s working today can quickly stop producing results. Whether you’re just spinning up a multi-channel strategy or already have fintech marketing campaigns using various channels, ongoing experimentation is essential.

By building experimentation into your fintech marketing strategy, you can stay on top of emerging trends and keep up with your customers’ shifting preferences. Consider testing things like:

- CTA language and placement

- Content, including both copy and graphics

- Different channels for specific messages

- Entire campaigns and workflows

Experimentation in action: Klar’s continuous improvement process

Fintech startup Klar’s commitment to experimentation has been a cornerstone of their success. By running hundreds of A/B tests at a time, they’ve made incremental changes to continuously improve key performance metrics, including boosting new-customer activation by 14%. Dive into Klar’s innovative fintech marketing approach.

Customer.io pro-tip: Employ multiple testing techniques

Journeys is built for continuous experimentation and optimization, with multiple testing methodologies available:

- A/B testing for virtually any aspect of a message

- Holdout testing to compare the results of sending a message versus sending nothing

- Multi-channel A/B testing for email, SMS, and push

Multi-channel, personalized marketing for fintech—at scale

Ultimately, all the fintech marketing regulations and KYC mandates you have to meet boil down to trust—and that’s a two-way street. While you’re verifying your customers’ identities, they’re evaluating your credibility too. Every message gives you a chance to show them why they should trust you with their financial lives. Make it personal, connect across multiple channels, and inspire confidence that leads to long-term loyalty. Personalized, multi-channel marketing at scale will get you there.

What better place to start establishing trust than the moment activation begins? Learn how to increase conversions with our free eBook: 5 keys to better fintech KYC and onboarding campaigns.