The Cost of Keeping Your Customers

Acquiring customers is addictive. Launching a Facebook ad, sending a targeted email promotion, hosting a webinar, and then witnessing your customer count go up feels really good. There’s that quick dopamine burst validating the effort put into your marketing campaigns.

But acquiring customers is actually one of the least effective levers for growth. In a 2015 study conducted by Price Intelligently, a 1% increase in your acquisition affects your bottom line by about 3.3%. Improving your retention by 1% affects your bottom line by around 7%.

In short, focusing on retention is twice as impactful as focusing on acquisition. Your web-based business doesn’t make money when a customer buys once or when a customer subscribes to your service for the first month. You make money months down the road because that customer is coming back time and time again.

By investing in retaining customers, the money you spend to keep, rather than acquire, your customers turns out to be a key investment.

Upfront CAC means your customer economics hinge on retention

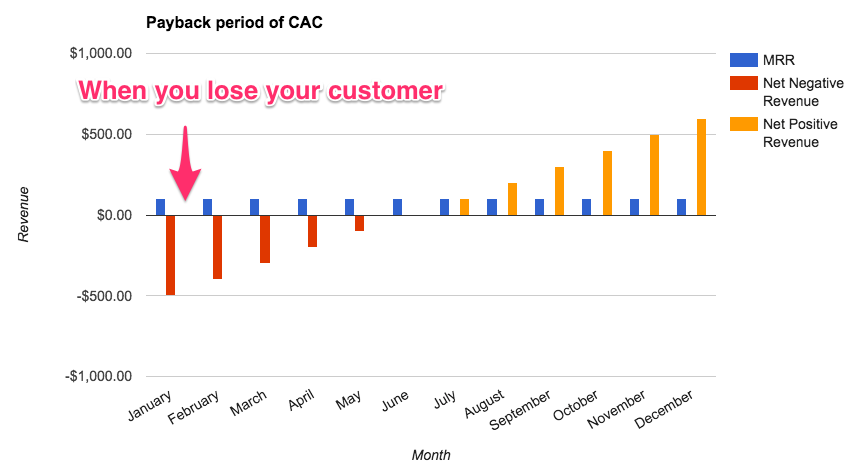

When your business model is subscription SaaS, e-commerce, or mobile app, the customer economics are similar. You’re spending cash up front in customer acquisition cost (CAC)—money which you theoretically make back over time through retention, repeat purchases, and continued engagement.

The amount of time it takes to recoup your initial CAC is known as its “payback period.”

For example, when you first acquire a customer in January, let’s say you’re $500 in the hole, and then you don’t drive enough revenue to break even—ending the payback period—until June. After that, however, you’re making pure profit: more than $500 of it in December. And that’s just for one customer.

The problem is that most of the time, customer attention doesn’t stay constant for that long. Even if people are highly engaged upon first signing up for your app, they’ll lose interest very quickly if they aren’t getting value.

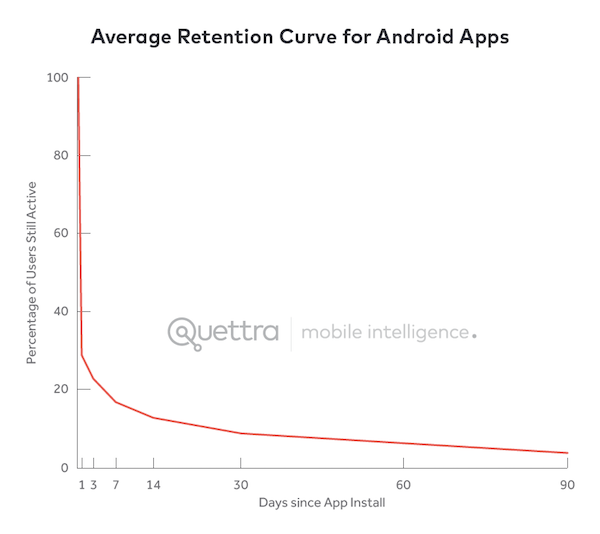

According to data from mobile intelligence startup Quettra, the average app loses 77% of its users after 3 days, and 90% within 30 days.

The shape of the engagement curve matches what you see across all kinds of tech businesses, including SaaS and e-commerce:

- Most e-commerce businesses bring fewer than 20% of their customers back to make a repeat purchase in a six month period.

- B2B SaaS trial conversion rates are between 3% and 5%, which means that most businesses lose as many as 97% of their customers in the early trial period.

Most of your customers are leaving soon after you’ve just made a huge outlay in CAC spend to bring them in. That means it’s likely you lose your customer while they’re net-negative to you—before they’ve stayed around long enough to “pay back” their CAC.

This is where high acquisition costs come back to bite you hard. Overfocusing on adding customers can distract you from keeping them, so that when you look at your customer economics, you find that you’re spending money to lose money.

Invest in user onboarding to lift your retention curve

The remedy to poor retention is investing in customer success, especially during the earliest stages of the lifecycle. When you bring on a new customer, your job’s not over yet. After expending acquisition costs and efforts, your next mission is to ensure that new customers get to see the value in your product.

This is your opportunity to drive growth. The period when customers are first active in your product after signup is your best chance to nurture them through subsequent milestones like their activation moment. Improve your onboarding to get more customers activated, and you shift your entire retention curve up. Here’s an illustration of this effect by Dan Wolchonok, who works on product and analytics at Hubspot:

Early investments in user onboarding don’t just improve your active customer count during that period. Early investments in user onboarding have a multiplying effect.

Improvements to Week 1 retention, for instance, will cascade over time. Customers who previously would’ve dropped out during the trial period, now activated, are retained through better onboarding and deliver monthly revenue over an entire year or more. That lifts your revenue for every month throughout the entire year.

For instance, if we apply the above retention curve to a SaaS charging $100/month, they would see a 46% increase in revenue from this cohort alone. Effectively, from just a 15% increase in retention, there is almost 50% more money under the blue curve above than the red. Increase early retention more, increase revenue more:

- a 15% month 1 lift results in a 46% increase in revenue

- a 32% month 1 lift results in an 100% increase in revenue

- a 52% month 1 lift results in an 160% increase in revenue

The beauty here is that these increases in retention not only cascade through the year for this cohort, but for every single cohort. That is, with this improved retention, your MRR will grow at faster rate.

From a relatively small increase in day 1 retention, you gain a huge revenue boost. The upshot is that a small amount invested in early-stage onboarding can pay huge dividends. By increasing your spend here on the cost of keeping customers rather than your customer acquisition cost, you can improve long-term retention and drive growth.

You don’t win when you acquire a customer. You win when you keep customers around.

The first obstacle to doing that is adoption. People have an inherent tendency to stay in the same place—and you’re asking them to take on a new habit. But those habits require maintenance, too. Whether you’re celebrating a successful user’s progress or reaching out to an inactive one to see what’s blocking them, you need to be sure your users continue to see the value in your product over time.

Keeping users delighted over the long-term is hard. It takes work to do it right—more work than it does to simply acquire a whole new batch of them. But if you do, you can build a business that lasts.